The simple answer is – “as early as possible”. Earlier you start with your Investment Journey, maximum time you have for your investment to grow.

- Importantly, the more you delay the start of your investment journey, the higher the chances of your missing out on additional returns. Hence, it is okay to start small and add to your investments as you go along.

- The earlier you start, you will have longer time to be invested and your investing skills will improve with experience and the richer your experience in the investment journey.

Here are some basic investment concepts to help you start:

- When you start investing, try to align your investment objective with the time available to achieve it. Some of your goals might be short term whereas, some of them might have a longer time horizon. This way you can segregate your investment objectives into short, medium and long term.

- Each type of investment must be done with suitable investment instruments taking into account level of volatility and amount risk involved. If you are investing towards a short term goal you would like to minimise the volatility associated with your investment since you would need the funds relatively sooner. If you have a longer time horizon to achieve your goal you can include instruments with higher volatility in your investment.

- It is important to understand your own risk appetite correctly before you invest to avoid heartburn later.

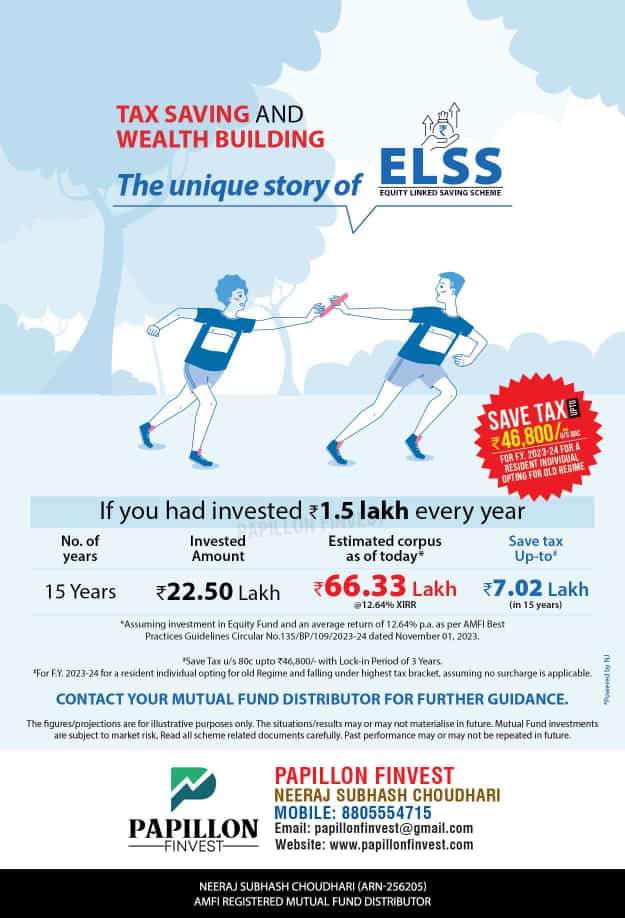

- A simple thumb rule would be to invest in equity instrument for the longer term and debt instruments for the shorter term.

- Equity instruments carry higher risk however, are likely to deliver higher returns in the long term. Debt instruments deliver stable, albeit relatively lower returns that equity.

- Equity instruments examples are stocks, equity mutual funds. Debt instruments are fixed deposits, debt mutual funds.

Finally, keep reviewing your investment performance periodically to confirm they are on track to help you achieve your investment objectives. Consult a Personal Finance Professional to evaluate your options and make informed decisions.