ELSS (Equity Linked Savings Scheme) can be a beneficial choice for tax-saving investments, particularly for those seeking investments in equity markets.

Here are reasons why ELSS is a good option:

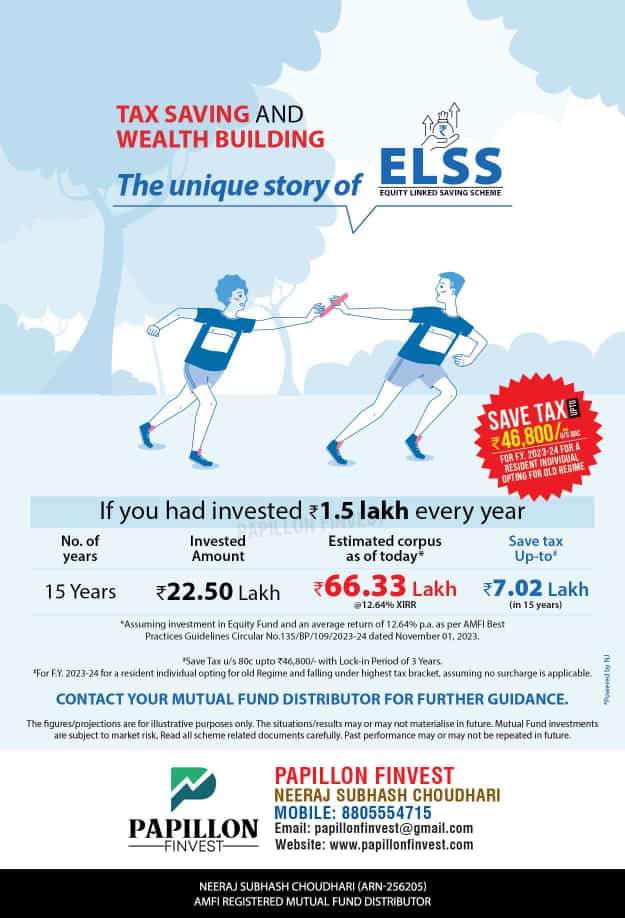

- Tax Benefits: ELSS allows investors to claim up to ₹1.5 lakh deduction from their taxable income under Section 80C of the Income Tax Act.

- Equity Exposure: ELSS primarily invests in stocks and equity-linked instruments, giving investors the potential to benefit from stock market growth.

- Lock-in Period: ELSS funds require investors to hold their investments for at least 3 years. This is shorter than most other tax-saving investments like Section 80C. The lock-in period promotes long-term investing, which can help grow your wealth over time.

- Returns Potential: Historically, investments in stocks and bonds (equity investments) have earned higher returns than more traditional tax-saving options like government-backed programs (such as PPF, NSC). However, it’s important to remember that past performance doesn’t guarantee future results. Equity investments carry higher risks because stock prices can fluctuate significantly.

- SIP option: Many ELSS funds provide the option to invest through a Systematic Investment Plan (SIP). With SIP, investors can invest at fixed intervals, fostering discipline. This approach helps in averaging out the cost of investments (rupee-cost averaging) and mitigates the effects of market fluctuations.

However, it is important that one must consider a few factors before investing in ELSS:

- Own Risk profile: ELSS funds invest in stocks, which are riskier than bonds. Consider your tolerance for risk and how long you plan to invest before putting money into ELSS.

- Market Fluctuations: Stock markets experience ups and downs. Don’t panic during short-term drops. Stay invested for a longer period to potentially take advantage of market cycles and maximize returns.

- Diversification: While planning any investment, it’s crucial to spread out your investments in different areas to reduce risk. While ELSS (equity-linked savings scheme) offers access to stocks, it’s wise to diversify across asset types like bonds, property, and gold for a well-rounded portfolio.

- Fund Selection: Not all ELSS options perform the same. Research or consult with financial advisor to choose funds with a stable performance history, skilled managers, and an investment approach that aligns with your goals.

What happens to my investment after the 3-year lock-in for my Tax Saver ELSS mutual funds ends?

Post the completion of the 3-year lock in of investment in ELSS Mutual Funds, your investment continues to grow like any other open-ended fund. You have the choice of redeeming the units or you could keep the investment for a longer time depending on fund performance and ROI.

Over each tax assessment year, you may invest into ELSS or contribute more (add to existing fund). In each instance, the investment will be locked for the next three years. Consulting a Personal Finance Professional will help you evaluate your options and make informed decisions.