It is important to take into account some key considerations making investment decision on a financial instrument or asset. Purely relying on past financial asset performance is no guarantee of future results. You would have come across this warning, especially in the case of Mutual Funds warning that one should not rely exclusively on historical performance. This is because past performance is not always indicative of future results. Situations and trends in financial markets can change and these changes often take place unexpectedly and suddenly. Hence, whenever you make any investment decision it is necessary to asses its merits and demerits.

Key things to consider:

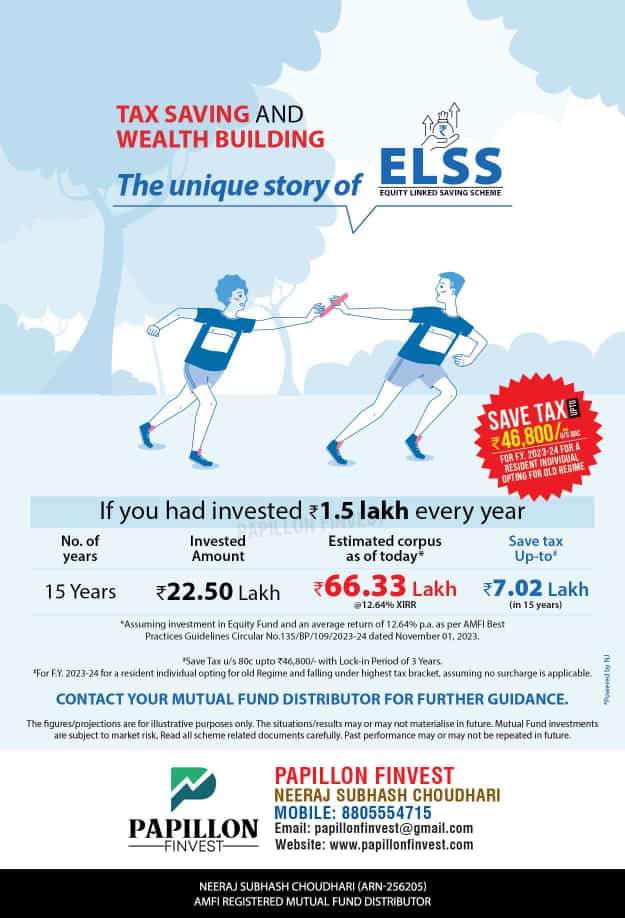

- When making any investment decision, it is necessary to accurately evaluate the long-term prospects of your investment and estimate its potential value.

- All investments involve some degree of risk. The first step to successful investing is figuring out your goals and risk tolerance – either on your own or with the help of a financial professional.

- One of the most important ways to lessen the risks of investing is to diversify your investments. By including different asset categories with varying level of risk-return ratios and varying performance cycles, you can protect against significant drawdown risk in your portfolio.

- Rupee cost averaging in SIP helps you deal with market fluctuations while saving you the trouble of having to track the market.

- It is advisable to set aside an emergency fund of up to six months of income in savings that can be used in case of need, so that your investment journey does not get derailed.

Conclusion

One should extensively research a particular mutual fund, asset class or strategy prior to selecting it. Do a deep dive into its merits and demerits. In other words, selecting the correct investment asset needs expertise. Consulting a Personal Finance Professional will help you to evaluate your options and make informed decisions.