Inflation plays a crucial role in financial planning since it erodes the purchasing power of money over time. To ensure that your financial plan remains robust and effective, it’s essential to consider inflationary factors and incorporate appropriate strategies into your financial planning process.

Steps you can take to mitigate its effects:

- What it is: Inflation reduces the real value of money, meaning that the same amount of money will buy fewer goods and services in the future.

- Impact on Savings and Investments: Inflation erodes the purchasing power of savings and fixed-income investments over time.

- What it means for Financial Planning: When setting financial goals, account for inflation by considering future needs and costs rather than focusing solely on nominal amounts.

- Retirement Planning: Adjust retirement savings goals and income projections to account for inflation’s impact on the cost of living during retirement.

- Investment Strategies to counter it: Diversify investment portfolios across asset classes to mitigate inflation risk and capitalize on growth opportunities in different economic environments.

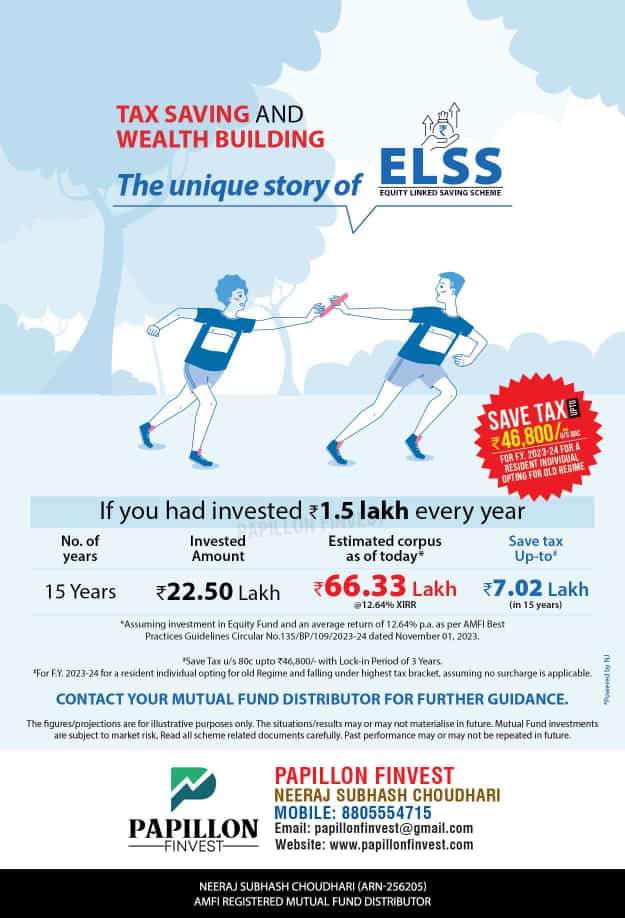

- Selection of correct asset classes: Invest in assets that historically have provided returns that outpace inflation, such as stocks, real estate, and commodities. Equity investments in stocks historically have provided returns that outpace inflation, making them a potential hedge against inflationary pressures.

- Review and adjust financial plan regularly: Regularly review and update your financial plan to ensure it remains aligned with your goals, risk tolerance, and changing economic conditions.

- Tax Planning: Inflation can push individuals into higher tax brackets over time, leading to increased tax liabilities..

- Emergency Fund and Cash Flow Management: Maintain an emergency fund with adequate reserves to cover unexpected expenses and mitigate the need to liquidate investments during periods of high inflation or market volatility.

Conclusion:

By understanding the impact of inflation on financial planning and implementing appropriate strategies, individuals can safeguard their financial well-being and pursue their long-term goals despite the challenges posed by inflationary pressures.

Regular monitoring and adjustments to financial plans are essential to adapt to changing economic conditions and preserve wealth over time. It’s always advisable to take the help of a Personal Finance Professional for creating your financial roadmap for achieving your important financial goals.